Private Label RMBS Valuation Workgroup (DWG)

Join the Private Label RMBS Valuation workgroup to collaborate and contribute to our work efforts!

What is the Private Label RMBS Development Workgroup?

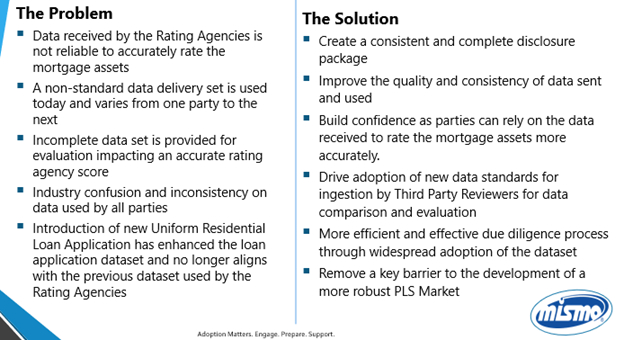

The Private Label group developed a standardized mortgage asset dataset to support rating agency asset valuation efforts necessary for securitizing residential mortgages.

Our group is responsible for defining and implementing a standard dataset and related materials for use in grading publicly traded private label mortgage-backed securities.

Key Deliverables include:

- Document the data requirements associated with the rating agency RMBS mortgage asset valuation requirements

- Identify and solve any gaps between MISMO standards and existing standards used by the rating agencies

- Finalize and publish MISMO standards for rating agency RMBS reporting requirements

- Promote and educate the new MISMO standard

Industry Need for PL RMBS Data Standards

Current Focus

- The PL RMBS specification was recently elevated to ‘Candidate Recommendation’ status, which means that it has been thoroughly reviewed by a wide range of organizations and industry participants and is available for use across the industry.

- The workgroup is seeking industry participants interested in adopting the specification.

How to Join

Anyone may participate in a MISMO development workgroup or community of practice regardless of membership status. Voting members of Information Management and Architecture Workgroup are elected as per governance procedures. Membership in MISMO is open to anyone - mortgage lenders, banks, credit unions, servicers, vendors, government agencies and more. MISMO members receive a voice, and vote, in creating and enhancing industry standards used by the entire industry. Learn more here.

Leadership

Julia Curran, SitusAMC, Co-Chair

Geran Combs, Actualize Consulting, Co-Chair

Facilitator

Erin Bittenbender, MISMO

[email protected]

Meeting Schedule

Meetings on hiatus until further notice.